Western State Bank may be old, having started its existence 112 years ago, but after more than 11 decades life is anything but sluggish at Western.

With 84 percent growth in assets since 2008, right through the depths of the Great Recession, Western is moving full-steam ahead into the future. With official headquarters located in North Dakota, Western has enjoyed a nationwide presence for the last 24 years through the reach of its business equipment financing subsidiary, Western Equipment Finance.

In 2007, the bank made another significant move beyond its traditional banking footprint with the launch of a loan production office in Chandler, Arizona. Presently, Western occupies a new, state-of-the-art facility in Chandler located at the intersection of Alma School Road and Chandler Boulevard. The second location for Western in Arizona was opened in Casa Grande, with the acquisition of the National Bank of Arizona branch located along Florence Boulevard. Most recently, Western acquired Central Arizona Bank in Scottsdale in May 2013, which is located in the Seville Center at Scottsdale Road and Indian Bend Road.

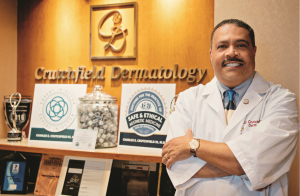

“Arizona has been a great market for Western and will be key to our future growth,” said CEO Brian Houkom. “Starting from the ground floor in the midst of the recession, we’ve grown to approximately $225 million in deposits and $200 million in loans in Arizona which we are very pleased with.” As CEO for the past 25 years, Houkom has seen a lot of changes in the industry and the organization, leading it from $25 million in assets to now over $725 million total assets.

Even though Western offers all types of loans, including personal and residential real estate loans, their primary focus is on the business customer, with offerings of real estate loans, equipment loans and revolving lines of credit. Western also offers a full array of cash management products and services, including remote deposit check processing, merchant processing and online banking.

“We’re a relationship bank,” Houkom said. “If a business is looking for a loan only and not a full banking relationship, we may not be the best fit for their organization. Our goal is to build a long-term relationship.”

The leadership seeks to separate themselves from the competition through their communication. “If we can’t fulfill a request, we communicate that right away,” Houkom said. “We act with a sense of urgency while communicating in a candid and respectful manner. Communication may seem like a simple act, right? It actually is, but it’s truly a way we’ve been able to differentiate ourselves from our competitors.”

Another differentiator is the depth of their customer relationships. Whether it’s the customer service staff, business banking assistants, loan officers or the CEO, the team as a whole has a depth of understanding of each customer relationship. “I’ve personally been on numerous prospect and customer calls with our Arizona team members to tell the story of the bank, including our operating philosophy,” Houkom said. “At Western, we aggressively manage the environment our employees work in. I’m not talking about physical things like buildings, office furniture or fancy bottled water. I’m talking about ensuring we all live our core values, including respect everyone, be curious and creative, listening is learning, do more than expected, communicate openly and often, improve someone’s life, be a team player and if something’s wrong make it right. Living those values is paramount to our success.”

“The services and products financial companies provide are generic so the only real difference is in the people and the service they provide,” he continued. “At Western, the employees are owners of the company; I believe that really does make a difference. They are motivated in a way that is different from other organizations that have employees who don’t have an ownership stake.”

Houkom and the team at Western are pleased to report that after more than a century of business, they are very secure in their business model. Bauer Financial has given Western a 5-Star Superior Rating, its highest rating, for several years. They are also pleased to announce that Western State Bank was ranked number six in SNL Financials Top 100 Banks of all U.S. banks with assets between $500 million and $5 billion.

“These ratings prove the strength of our staff, management and the markets we serve,” Houkom concluded.